SNAPshot: January 2026

A Benny Insights Report

Rishi Ahuja

Feb 10, 2026

Executive Summary

January brought a post-holiday pullback in SNAP household spending on Benny. Total grocery spend per user declined 15%, while items purchased fell 7%, indicating a shift toward lower-cost purchases rather than reduced volume.

Key findings:

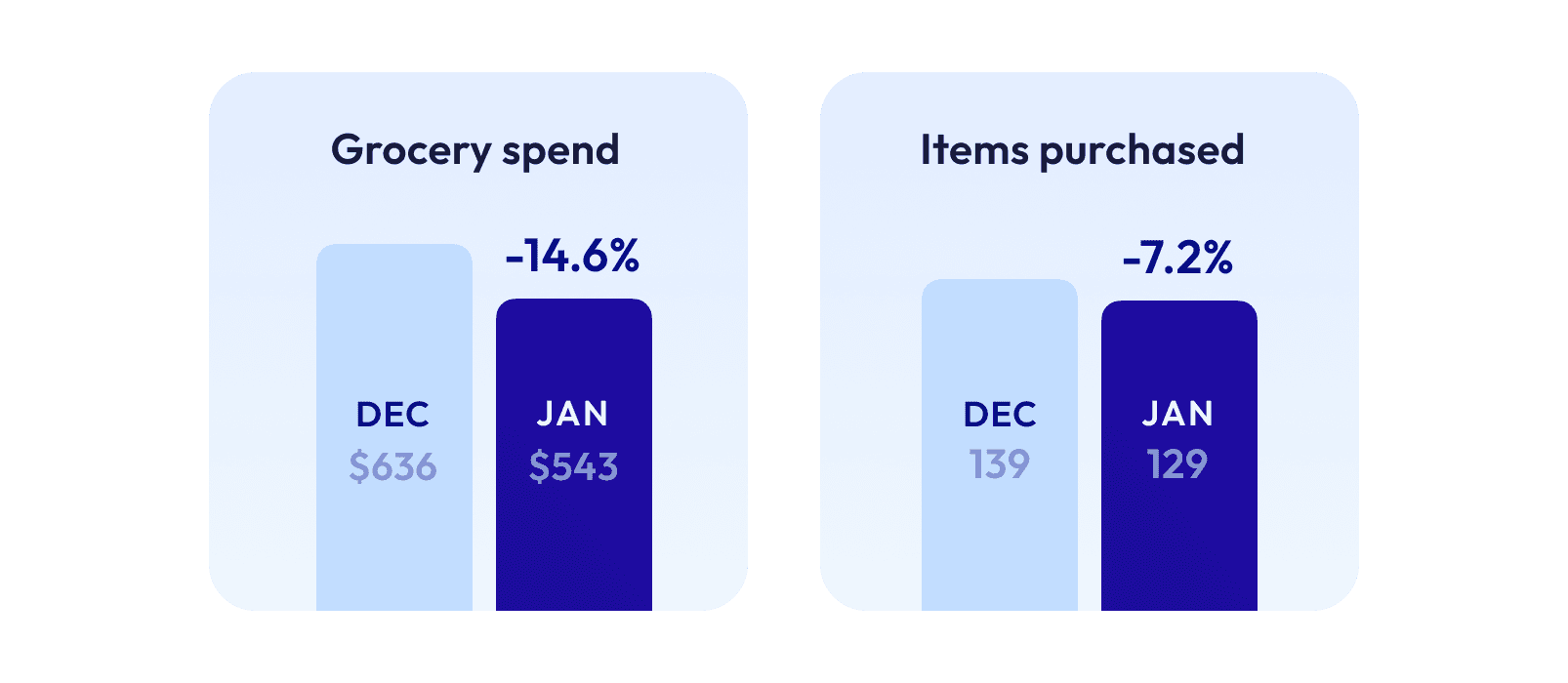

Total grocery spend decreased 14.6% month-over-month, consistent with post-holiday normalization patterns seen across retail.

Items purchased fell 7.2%, a smaller decline than spending. The 7-point gap suggests households maintained purchase frequency while shifting category mix.

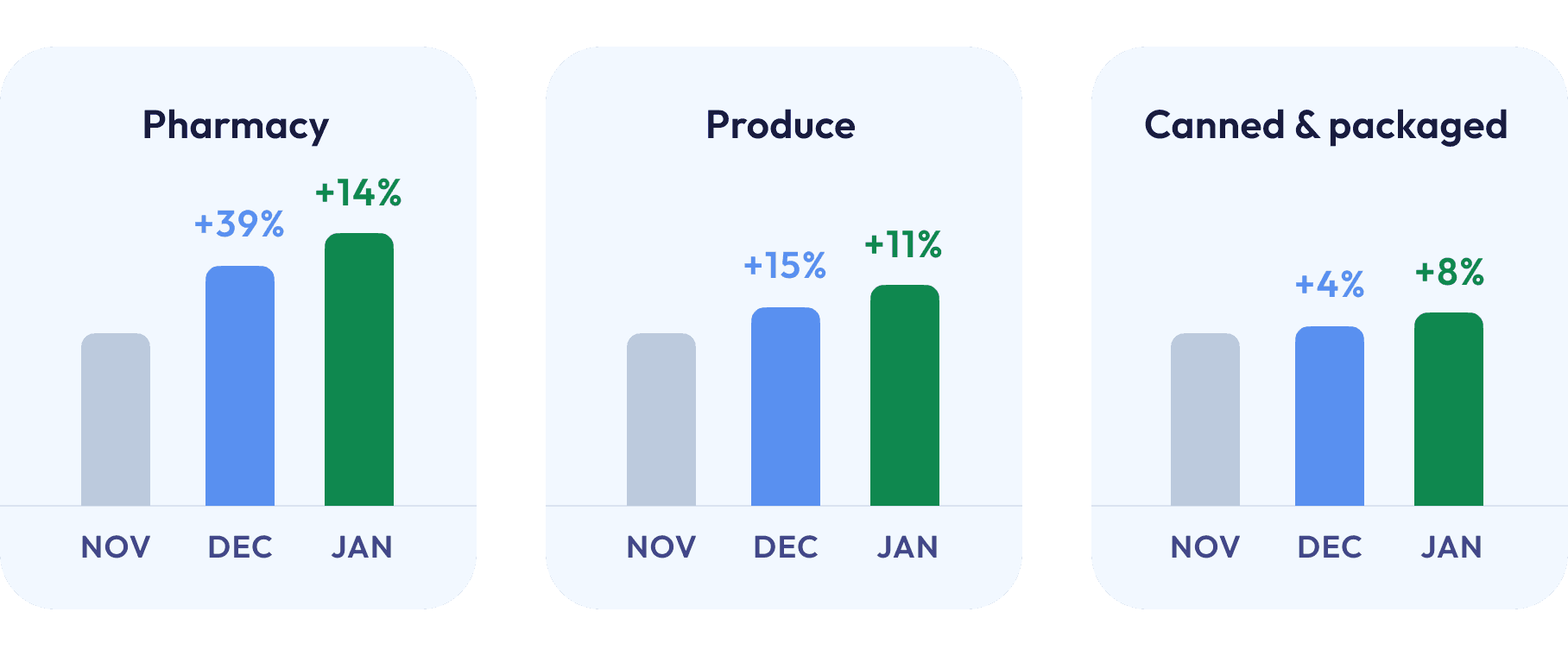

Three categories grew: Vitamins & supplements (+14%), produce (+11%), and canned & packaged foods (+8%) were the only categories to increase from December.

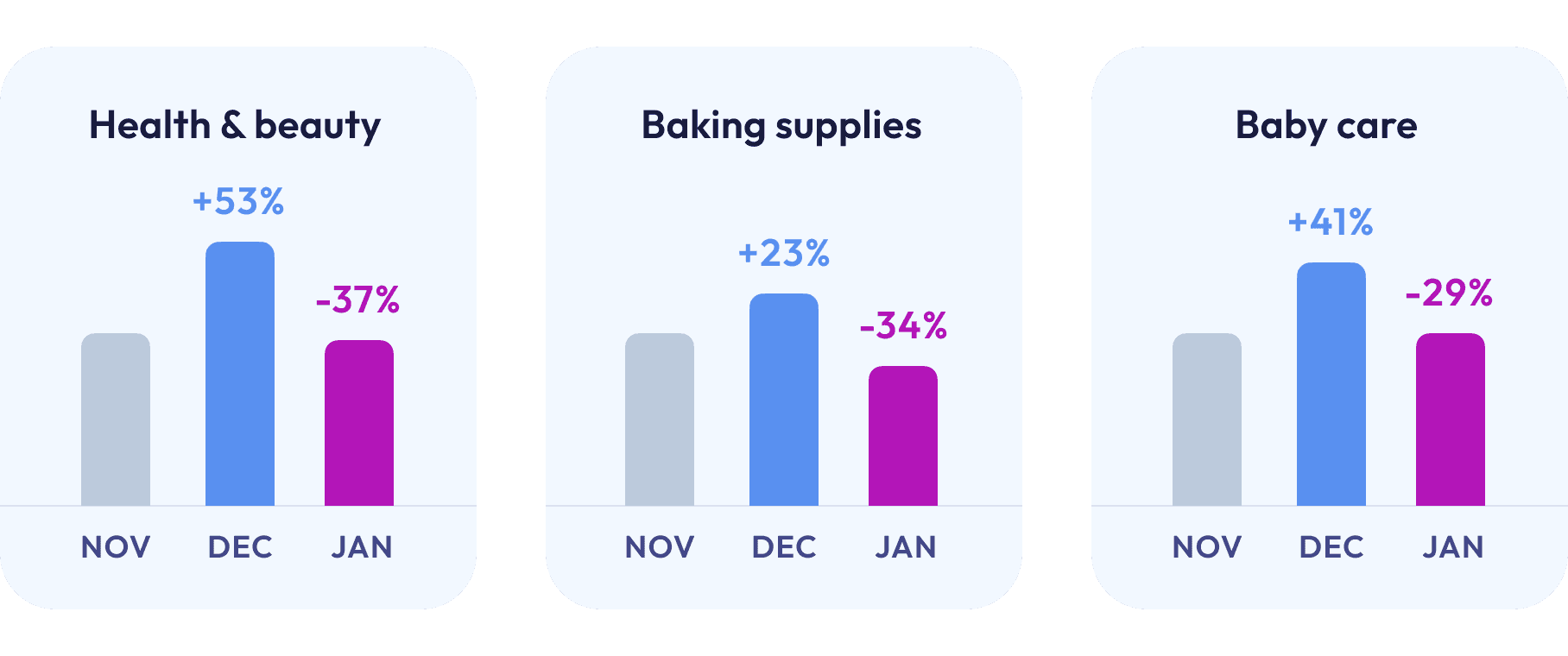

Holiday-driven categories declined sharply: Baking supplies (-34%), health & beauty (-37%), and baby care (-29%) all reversed December's elevated levels.

Core food categories held steady: Meat & seafood (+0.5%), frozen foods (+0.2%), and breakfast foods (-0.2%) saw minimal movement despite overall spending decline.

Methodology

Grocery Spend Overview

January per-user metrics returned closer to November 2025 baseline levels after December's seasonal peak.

Metric (per user) | Dec '25 | Jan '26 | MoM change |

|---|---|---|---|

Grocery spend | $636 | $543 | -14.6% |

Items purchased | 139 | 129 | -7.2% |

Category Performance

Category-level data reveals where households cut spending and where they increased it.

Categories That Grew in January

Category | Spend (per user) | MoM change |

|---|---|---|

Vitamins & Supplements | $1.85 | +14.3% |

Produce | $22.00 | +10.7% |

Canned & Packaged Foods | $27.65 | +8.4% |

Condiments & Sauces | $17.23 | +1.5% |

Largest Declines in January

Category | Spend (per user) | MoM change |

|---|---|---|

Health & Beauty | $21.92 | -36.9% |

Baking Supplies | $7.99 | -34.2% |

Baby Care | $6.48 | -29.3% |

Pet Supplies | $11.77 | -17.3% |

Snacks | $47.93 | -16.7% |

Deli & Prepared Foods | $9.63 | -16.4% |

Post-Holiday Category Normalization

The sharpest declines came from categories that spiked in December:

Health & beauty dropped 37% after a 53% December increase

Baking supplies fell 34% after rising 23% in December

Baby care declined 29% following a 41% December surge

Snacks fell 17% after jumping 37% in December. Deli & prepared foods (-16%) and beverages (-6%) also pulled back after December gains of 33% and 23%, respectively.

Meanwhile, three categories increased:

Vitamins & supplements climbed 14% after jumping 39% in December

Produce rose 11% in January following a 15% gain in December

Canned & packaged foods grew 8% after a modest 4% December growth

Core proteins and staples saw minimal change: meat & seafood (+0.5%), frozen foods (+0.2%), spices & seasonings (+0.5%), breakfast foods (-0.2%), and dairy & refrigerated (-2%).

Spend vs. Volume Gap

Items per user declined 7% while spending per user fell 15%, creating an 8-point differential. This pattern—volume declining slower than dollars—typically indicates a shift in product mix rather than reduced shopping frequency.

Households bought 10 fewer items per user on average (129 vs. 139) while spending $93 less ($543 vs. $636). The average per-item spend dropped from $4.57 in December to $4.20 in January.

What This Means

Looking Ahead to February

February data will show whether:

Produce and canned foods maintain January's elevated share

Meat and frozen spending increases

The per-item spend gap (Dec: $4.57, Jan: $4.20) narrows or widens

Grow your brand with SNAP shoppers.

Book a call